As the legal landscape evolves and consumers become more and more discerning in their choice of legal services, family law attorneys face increasingly complex challenges in attracting and retaining clients. Firms that rely solely on word-of-mouth referrals and conventional advertising are now finding it difficult to stand out from the crowd. You don't want that to be you.

The benefits of digital marketing for family law attorneys cannot be overstated. With the right online strategies, divorce lawyer marketing can help firms increase their visibility, connect with potential clients, and build their reputation as trusted legal experts.

Family law attorneys can use various digital marketing tools to set themselves apart from their competitors, from social media and pay-per-click (PPC) to search engine optimization (SEO) and email marketing.

In this comprehensive guide to family law marketing, we will explore what makes marketing for family lawyers special and the top 12 tips on how to get more clients for family law firms.

What Makes Marketing for Family & Divorce Lawyers Special?

As a family law firm marketing agency, we understand that marketing for family and divorce lawyers requires a distinct approach due to the sensitive nature of the issues involved. These issues often involve highly emotional and sensitive topics such as child custody, alimony, property division, and domestic violence. Building trust and credibility by showcasing the lawyer's experience, qualifications, and testimonials from satisfied clients is essential.

Also, many prospective clients may be unfamiliar with family law's legal processes, so educating them on the process is important.

Finally, having a strong digital presence is crucial for family law firms since clients often prefer to research lawyers online before reaching out, especially since family law matters tend to be private. The website should be informative, user-friendly, and engaging, with useful content that draws potential clients.

Top 12 Tips for Family Law Marketing that Bring Clients

1. Go Digital with a High-Performance Family Law Website

Your family law firm website is your public persona. Because all your marketing efforts will funnel back to your law firm's website, your website needs to be professional and high-performing. Your website should not look or navigate like it is 20 years old.

At the minimum, family law websites should:

- Be mobile-friendly: More than half of your website visitors are on their cell phones, so you cannot overlook the mobile visitor's experience.

- Be intuitive: Your organizational structure should make sense. For example, a page titled “Awards And Recognition” should be on a section called “About Us,” not “Practice Areas.”

- Have a positive UX: User experience is the level of satisfaction website visitors (including your potential clients) have. Suppose your website induces frustration due to slow loading. In that case, text that does not convert to the screen size, or buttons that simply do not work, your website visitors will leave, and you will miss out on a possible conversion. Without giving it a second thought, your website visitors should understand where on the site they are and how to find information on the website.

- Be built for search engines: Your content is written for your human readers, but your website must be designed so that it will work with search engines.

Grow Law Firm has a quickly growing, extensive portfolio of clients. We pride ourselves on our law firm's website design services.

2. Leverage SEO for Divorce and Family Law Marketing

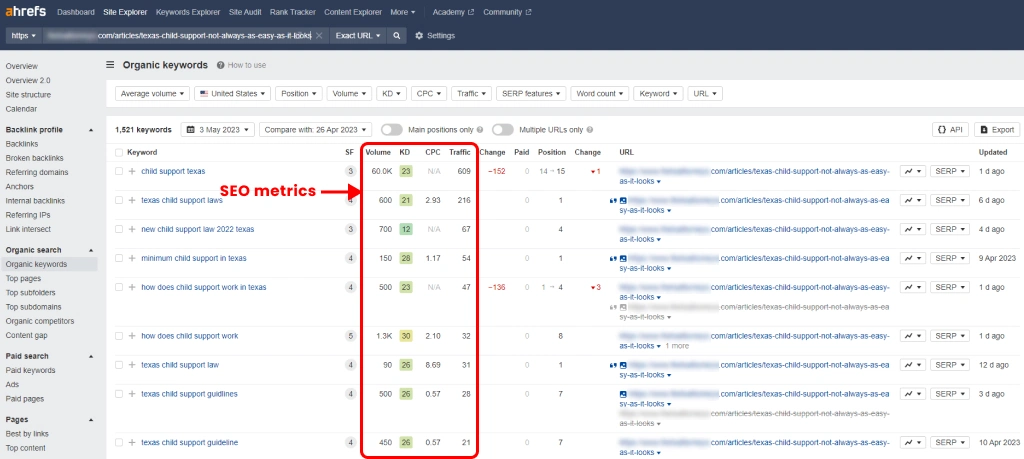

SEO for lawyers (Search Engine Optimization) is a key component of family and divorce law firm marketing services. It involves optimizing your website and content to rank higher in search engine results pages (SERPs) for specific keywords and phrases. It involves making your website easy for search engines to understand and identifying the keywords your potential clients use to search for family law services like yours.

When it comes to generating leads through family law marketing strategy, SEO can offer several benefits, such as:

- Increased website traffic: Optimizing your website for specific keywords can help you rank higher in search results, increasing your website traffic.

- Improved credibility: When your website appears at the top of search results, it gives the impression that your practice is trustworthy, professional, and authoritative.

- Reduced marketing costs: SEO is a cost-effective way of generating leads compared to other forms of law firm marketing, such as paid advertising.

- Better user experience: It involves optimizing your website for search engines and users. This means that your website is designed to be easy to navigate, load quickly, and provide relevant and useful information to users.

3. Provide Expert Family & Divorce Law Content

Content is information and media that you publish on the web - and your content is critical to your family law practice SEO efforts (and your visitor's UX). If you do not have website content for lawyers or plagiarized or spammy content, your website will have limited visibility in SERPs.

Family law firms and divorce law firms can provide uplevel their website content and optimize it for search engines by:

- Writing long-form content that covers a wealth of valuable information on a single topic

- Adding new content on a frequent, regular basis

- Incorporating relevant keywords (short-tail, mid-tail, and long-tail) based on our extensive research

- Including headings and subheadings which will inform search engines what the content is specifically about

- Keeping a conversational tone in copy to keep the reader engaged

- Adding visuals to supplement long sections of text copy

- Providing relevant and valuable data, information, and statistics that readers will want to bookmark or share

- Highlighting your unique experience, skills, and knowledge

- Sharing former clients' experiences and testimonials (with their permission).

SEO-optimized content includes long-form pages describing family law and divorce services, blog posts, case stories, and more. You should update evergreen pages from time to time to stay relevant. You should also update website content if parts of divorce or family law in your state change.

4. Create Detailed Family Law Practice Area Pages (Service Pages)

Informative, in-depth service pages, or law practice pages, allow family law firms to rank organically for searches in Google and other search engines. By having a dedicated page for each of the family law practice areas, you can showcase your knowledge and allow your website to show in SERPs for individuals researching their legal issues. Examples of service pages for divorce attorneys could include:

- Alimony and maintenance: The page should explain the factors determining spousal support (alimony) and maintenance payments after a divorce. It may also provide resources for calculating potential payments.

- Child custody: This page should outline the legal considerations for determining child custody laws after a divorce or separation. It may provide guidance on factors that courts consider when deciding custody arrangements and offer tips for negotiating custody agreements.

- Child support: This page could discuss the financial responsibilities of parents after a divorce or separation, including how child support payments are calculated and enforced.

- Collaborative divorce: This page details the collaborative divorce process, which involves couples working together to develop a mutually beneficial settlement agreement without going to court.

- College expense planning: This page provides information for parents about how to plan financially for their children's higher education after a divorce.

- Dissipation of assets: This page should explain what happens when one spouse wastes or misuses marital assets during a divorce process.

- Domestic violence: This page offers resources and support for victims of domestic violence during and after a divorce.

- Foreclosure defense: This page may offer guidance and support to prospective clients facing foreclosure due to the financial strain of a divorce.

- High net worth divorce: This page provides specialized family lawyer services for clients with high net worth and complicated financial situations.

- Legal separation: This page should outline legally separating from a spouse without a final divorce decree.

- Post-divorce disputes: The page can offer legal support and resources to clients experiencing disputes regarding property division, child custody, or other issues after a divorce.

- Premarital agreements: This page should explain the legal considerations and benefits of signing prenuptial agreements before marriage.

- Tax planning: This page should provide guidance on how to minimize tax liabilities during and after a divorce, particularly for those with complex financial arrangements.

Service pages for family attorney websites are an initial investment but a necessary one. Although the content on these pages is written for your audience, you should construct them with search engines in mind. Ideally, they should be 1,000 words long, provide relevant information about your services, and incorporate appropriate keywords. The more valuable, relevant, and unique content you provide on your website, the better.

5. Get Down to Local SEO for Divorce Lawyers Marketing

Local SEO for lawyers matters now more than ever. In post-COVID times, “near me” searches have grown substantially, and people look for family law and divorce services in their local vicinity. Along with SEO optimization goals, family law practices should have SMART goals and strategies linked to local searches. Your local search plan of action should include the following:

- Updated law firm Google Business Profile (formerly Google My Business)

- Regularly publishing localized content

- Established a presence on local websites (like Yelp) and legal directories

- Having a law firm policy to ask for reviews from clients.

Your law firm marketing budget can also include local campaigns so that you can stand out in local searches for a zip code or neighborhood.

6. Leverage the Power of Testimonials for Family Law Firm Marketing

Testimonials are statements, comments, or reviews given by clients who have experienced the services of a particular family law firm. They provide potential clients with social proof of the quality of family law practice services offered by the law firm. Their benefits include:

- Credibility: Positive comments from satisfied clients can enhance the law firm's reputation and establish it as a trustworthy and reliable source of family law lawyer services.

- Differentiation: A testimonial highlighting a unique aspect of the law firm's service can catch the attention of potential clients and help them make an informed decision.

- Emotional connection: The positive experiences shared by previous clients can evoke empathy, creating an emotional bond that can lead to conversions.

- Increased conversions: People tend to trust the opinions and experiences of others, and a positive testimonial can lead to more people hiring the law firm's services.

7. Start Link Building for More Family Law Leads

Link building remains an effective off-page SEO tactic, but law firms doing this on their own should proceed with caution. It's possible to severely undermine your family law firm's link-building efforts if your backlinks are spammy, irrelevant, or low-quality. You can generate quality links by acquiring links to your website from:

- Profiles on legal directories

- Profiles on local business directories

- Legal article websites

- Being featured in local news stories

- Creating shareable infographics

- Charitable donations/ sponsorships

- Press releases.

Link building can seem daunting but should be included in SEO strategies. Be wary of any shady link-building tactics or “too good to be true” link-building offers. And definitely, do NOT buy 1,000 backlinks for $10 (yes - these offers exist).

8. Get Listed on Family Law Directories

Family law directories are online resources that help potential clients find family attorneys in their area. They typically include information about lawyers' practice areas, experience, and contact information. Some popular legal directories on which a divorce attorney can be listed are Avvo, Justia, HG.org, Super Lawyers, FindLaw, Lawyers.com, etc.

Legal directories are trusted information sources for people searching for legal services. Furthermore, these directories have high domain authority, so having a link to your website on these directories can help increase your site’s credibility with search engines. They also increase your visibility to prospective clients seeking legal assistance and validate your law firm’s legitimacy and expertise in your practice area.

So, how do you choose a law directory?

- Relevance: Look for directories relevant to your practice area and location. Don’t waste time or money listing your firm on directories that won’t attract your target audience.

- Reputation: Choose directories that have a good reputation and are trusted sources of information. Look for directories that are widely used by people searching for legal services.

- Traffic: Check the directory’s traffic statistics to ensure it gets enough traffic to make a listing worthwhile.

- Cost: Consider the cost of listing on the directory and whether it fits into your legal marketing budget. Some directories offer free listings, while others charge a fee if you want the additional perks.

- Features: Look for directories that offer useful features like reviews and ratings, social media integration, and search engine optimization tools. These features can help improve your visibility and credibility on the directory.

9. Utilize the Strength of Paid Ads for Family Law Advertising

Paid advertising, commonly known as PPC or pay-per-click, is a type of online advertising where advertisers pay a fee each time one of their ads is clicked. This model is commonly used in search engines, social media, and display advertising.

For family lawyers, PPC can be highly beneficial in several ways. Firstly, it allows them to reach their target audience more effectively as they can specifically target ads to users searching for family law-related keywords or interests. With PPC, you only pay when someone clicks on your ad. This makes it a cost-effective way to generate leads and acquire new clients.

Unlike other forms of advertising, PPC allows you to see immediate results. Your ads will appear in search results as soon as your campaigns are launched, allowing family lawyers to start seeing results immediately.

In addition, PPC offers a higher level of control and flexibility compared to traditional advertising. Family lawyers can adjust their ad campaigns based on real-time data, such as click-through and conversion rates, allowing them to optimize their advertising efforts for maximum effectiveness.

There are several types of PPC ads that family lawyers can use to advertise their services, including:

- Search ads are text-based ads that appear at the top of search engine results pages when someone searches for specific keywords related to your practice area.

- Display ads: These appear on web pages and social media platforms. They can be targeted to specific demographics and can be an effective way to build brand awareness.

- Retargeting ads: These are shown to individuals who have already visited your website or interacted with your brand in some way. They are designed to keep your brand and services top of mind.

- Social media: These are ads displayed on social media platforms like Facebook and Instagram.

10. Think of Social Media Marketing for Family Law

Social Media Marketing refers to the use of various social media platforms to promote the services of a family law lawyer or law firm. These platforms are tools used to attract and engage prospective clients, build brand awareness, and establish credibility in the industry.

Tips on how to use different social media platforms as a family lawyer/law firm include:

- Facebook: Create a business page on Facebook and regularly post content related to family law, such as blog articles, news updates, and helpful tips for clients. Engage with followers by responding to comments and messages promptly.

- Instagram: Use Instagram to showcase your law firm's personality and share visually appealing content, such as infographics, photos of your team, and inspirational quotes related to family law.

- Twitter: Tweet out news updates related to family law and share informative articles or blog posts. You can also use hashtags relevant to your practice area to increase your reach and visibility.

- LinkedIn: Create a professional profile on LinkedIn and participate in industry-related discussions. Share your expertise through blog posts or articles, and connect with prospective clients or referral sources.

- YouTube: Create videos that explain common legal issues related to family law, share client testimonials, or highlight case studies. You can also collaborate with other legal professionals on YouTube to increase your exposure.

11. Email Marketing for Family Lawyers

Email marketing strategy is a cost-effective and impactful way for family and divorce attorneys to promote their services and build relationships with prospective clients. It lets you stay connected through personalized communication and tailored messaging with existing clients, update them on legal developments, and offer relevant resources.

Furthermore, you can use it to grow your client base by offering free legal resources, introducing your firm, or showcasing your expertise. Some content ideas for family and divorce attorney email newsletters are:

- Legal advice and updates: Share legal advice relevant to your clients, such as changes in divorce laws or how to handle child custody disputes.

- Success stories and testimonials: Share stories and testimonials about successful cases you've handled to demonstrate your expertise and generate trust with your audience.

- Events and webinars: Promote upcoming events and webinars hosted by your firm to educate and engage with clients and prospects.

- CTA: Include a clear call-to-action in each email, such as booking a consultation or signing up for an educational event.

- Best practices: Offer best practices for family law firm clients, such as communicating with a soon-to-be ex-spouse or preparing for court.

Overall, email marketing is a powerful tool for family and divorce attorneys to improve their law marketing efforts.

12. Start a Family Law Attorney Podcast

As a family law attorney, you understand the stress and anxiety that your clients go through during a divorce. A podcast can be an excellent way to connect with those facing legal family law and divorce issues and provide them with valuable information and support.

You can showcase your expertise and experience as a family law attorney by providing legal insights and advice on your podcast.

Podcasts are becoming increasingly popular, offering a unique opportunity to reach potential clients who may not be actively searching for legal services. A podcast is a great way to build a personal connection with potential clients. You can create a sense of trust and goodwill by sharing information about your experiences and the clients you have helped.

When it comes to content for your law firm podcast, you could cover various topics. Here are just a few ideas:

- Explaining common legal terms and concepts. Many people are intimidated by the legal process and may not understand certain legal terms. Breaking complex concepts into simple language can help listeners feel more comfortable and informed.

- Sharing personal stories and experiences. Divorce and family law issues can be emotional and deeply personal. By sharing your experiences and those of your clients, you can offer listeners a glimpse into the process.

- Answering frequently asked questions. People going through a divorce often have many questions about the process. By addressing common questions and concerns, you can provide valuable information to future clients and establish yourself as an authority on the subject.

- Providing practical advice. Whether it's tips for negotiating a fair settlement, advice on how to co-parent effectively, or suggestions for coping with the emotional toll of divorce, offering practical advice can be a powerful way to help your listeners and attract new clients.

Families First: Build Your Family Law Practice Today!

Marketing a family law firm can be challenging, but it is essential for gaining new family law clients. Whether you are a divorce or family attorney, crafting a powerful brand message that resonates with your target audience is crucial. Our family and divorce law firm marketing services can help you excel in this.

Some key tips for marketing your family law firm include investing in SEO, using PPC, creating a high-performance website, leveraging social media, listing your firm on directories, and using other forms of online legal marketing.

Keep in mind that digital marketing for divorce attorneys takes time, so you should consider taking advantage of the services of a professional law firm SEO agency like Grow Law Firm while you focus on other tasks.

We specialize in helping family law firms with website design and optimization, SEO, and PPC to drive results. Our team of experts can work closely with you to identify your unique needs and goals and implement strategies that help you get more family law clients.

.webp)

.webp)

.webp)

.webp)

.webp)